Outline for mid-life investors

The following outline is provided as an overview of and topical guide for mid-life investors.

Mid-life investors, for the purpose of this article, are perhaps about 30 to 55 years old. They are building their careers and their families. Mid-life investors are converting their human capital into financial capital by building portfolios and accumulating assets in pension plans, in preparation for retirement. Mid-life investors have to manage their expenses and liabilities, like a mortgage and other loans: it is a balancing act. Hopefully their net worth is growing over time, and they have embraced long-term financial planning.

This article is intended to help a reader learn about a subject quickly, by showing what topics it includes, and how those topics are related to each other.

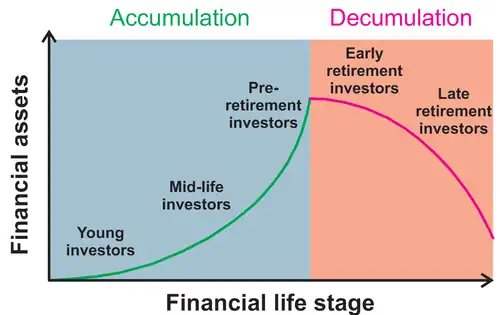

The financial life cyle

Mid-live investors are in the second stage of the financial life cycle, within the accumulation phase.

Banking, budgeting and emergency fund

- Make sure you are not spending too much on banking fees

- Update your budget to stay on top of your spending

- Check that your emergency fund is sufficiently large

Credit and managing debt

- Manage your debt and continue to make smart credit choices

- Check your credit report regularly, maintain a good credit record and protect yourself from fraud

- Pay off any remaining student loans and car loans

- Manage your credit card(s) and perhaps your line of credit

Work-related financial choices

- Contribute to employer pension plans and group retirement plans

- Stay up to date on your employee benefits

Housing-related choices

- Review the pros and cons of owning versus renting a dwelling

- Possibly manage a mortgage

Insurance

- Review the types and general principles of insurance

- If becoming a home owner, look at home insurance, mortgage insurance and possibly title insurance

- If renting a house or an apartment, you need tenant insurance

- Evaluate if you now need life insurance and disability insurance

Investing: the basics

- Refresh your memory about compound interest and the importance of saving early

- If also paying back loans, consider paying down loans versus investing

- If not already done, create a financial plan and get started on investing

- Re-evaluate if you want to contribute to a Tax-Free Savings Account (TFSA) or a Registered Retirement Savings Plan (RRSP) (see also TFSAs versus RRSPs), or both

- If you are able to place your investments in several different kinds of accounts, see prioritizing investments

- Think about your savings rate: are you saving enough?

DIY investing

- Read about portfolio design and construction and see if you should revise your portfolio

- Review your asset allocation, taking into account risk and return

- Look at simple index portfolios or asset allocation ETFs for the simplest do-it-yourself (DIY) options

- Rebalance your portfolio regularly

- Write down your plan as an investment policy statement or a simplified investing plan for short term goals

- If you have determined that you won't succeed at DIY investing, or if you need help with planning, consult a financial advisor

You have a spouse or children

- Draft or update your will, your power of attorney documents(s), and designate guardians for minor children

- Contribute to Registered Education Savings Plans (RESPs) for children

- Revisit your insurance coverage (see the relevant section above)

What's next?

Some very motivated savers/investors may become financially independent during this stage of life. Most people will continue working another 5, 10 or 15 years, during a "pre-retirement" stage.

See also

References

External links

- RetireHappy.ca, Financial Stages of Life